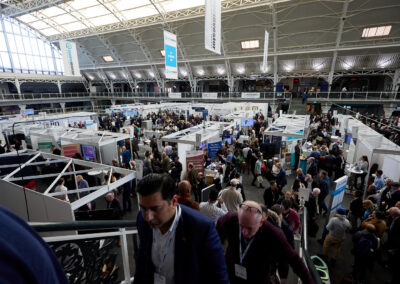

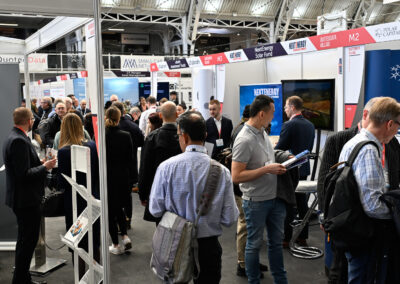

The UK's biggest event for private investors

Master Investor Show 2024Connecting companies with investors

- Learn from expert speakers how to make the most of their savings.

- Talk directly to CEOs of companies they can invest in.

- Hear leading entrepreneurs, investors and fund managers speak about future trends and opportunities.

- The Master Investor Show is now the UK’s leading, must-attend event for private investors.

Want to find out more? Watch the 3-minute highlights video of the 2024 event below to get a first-hand impression.

Presentations coming soon

Presentations

Main Stage

Panel Discussion: Future-proofing your portfolio | Technologies of the future to invest in today

Led by Joanne Hart, Investment Editor at Mail on Sunday, this panel discussion explores some of the best and most exciting investment opportunities that arise from three of the most central technologies of the future: climate change, life sciences, and AI. Panelists include Jonathan Maxwell, CEO at Sustainable Development Capital LLP, Drew Burdon, Partner, EQT Life Sciences at EQT Group, and Barry Downes, Sure Valley Ventures Managing Partner and Mindflair Adviser.

The Mercantile Investment Trust plc | Perception versus Reality – UK Mid-Caps Today

Guy Anderson, Portfolio Manager at The Mercantile Investment Trust plc, makes the case for investing into UK mid- and small-caps, and explains the portfolio strategy of The Mercantile Investment Trust. He also gives an outlook on macroeconomic developments and outlines how the trust’s portfolio is positioned for the coming years.

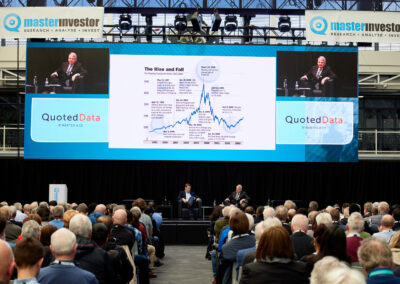

Jim Mellon in conversation with Wilfred Frost

Jim Mellon and Wilfred Frost, News Anchor at Sky News, reflect on macroeconomic, political and market developments both in the UK and internationally, and how best to position one’s investment portfolio.

JPMorgan Global Growth & Income plc | Take a Global Perspective

James Cook, Portfolio Manager at JPMorgan Global Growth & Income plc, makes the case for investing into global equities, and outlines the key criteria for selecting stocks at JPMorgan Global Growth & Income plc. He also gives an overview of the trust’s performance and global portfolio.

Shifting Shares | How to make £1m in 4 steps

Michael Taylor, Founder of Shifting Shares, outlines his personal strategy, top tips and caveats for long-term investing success.

Auditorium

NextEnergy Capital | NextEnergy Solar Fund “Once in a generation dividend yield opportunity, portfolio update, and growth strategy”

Peter Hamid, Vice President at NextEnergy Capital, makes the case for solar as an asset class, and explains the challenging conditions faced by small- and mid-cap listed investment companies. He also gives an overview of the NextEnergy Solar Fund’s portfolio and past performance, as well as a strategy update.

J.P. Morgan Asset Management Panel Session | A Have your cake and eat it – targeting both income and growth

Led by Simon Elliott, Client Director at J.P. Morgan Asset Management, this panel discussion highlights different ways of targeting both attractive dividend levels and long-term capital growth across UK equities, European equities, and emerging markets equities. Panelists include portfolio managers Isaac Thong of JPMorgan Global Emerging Markets Income plc, William Meadon of JPMorgan Claverhouse plc, and Alexander Fitzalan Howard of JPMorgan European Growth & Income plc.

Witan Investment Trust plc | Witan Investment Trust. A Share in Global Growth

James Hart, Investment Director at Witan Investment Trust plc, discusses the Witan Investment Trust plc’s multi-manager strategy, and gives an update on the trust’s performance and portfolio positioning.

abrdn | Murray International Trust: The Global Macro Outlook for 2024

Martin Connaghan, Co-Manager at Murray International Trust PLC and Investment Director at abrdn, discusses some elements of the current global macro backdrop, as well as the positioning of and outlook for Murray International Trust.

WS Blue Whale Growth Fund | A High Conviction Approach in an Uncertain World

Stephen Yiu, Lead Manager at WS Blue Whale Growth Fund, recaps the WS Blue Whale Growth Fund’s performance since its launch, with a particular focus on Nvidia as the largest position. He also explains how the fund’s approach and positioning aim to address the ongoing geopolitical and macroeconomic uncertainty.

QuotedData | How to play the recovery in renewables and infrastructure stocks

Edward Marten, Co-founder and CEO at QuotedData, and James Carthew, Co-founder and Head of Investment Company Research at QuotedData, explore the discount opportunity that currently exists within the infrastructure and renewables sector, and give some examples of attractive funds in this space.

Quantinuum | Quantinuum: Growth of a $5 billion company

Ilyas Khan, Chief Product Officer at Quantinuum, introduces Quantinuum as the world’s largest quantum computing company. He also highlights the increasing importance of deep science, explores the impact of quantum on AI, and gives an outlook on the next generation of AI.

Tips from the Experts

Led by Mark Watson-Mitchell, Contributor at Master Investor, this discussion explores the potential of the UK and global stock markets in the context of macroeconomic developments, and shares some favourite companies and their stocks. Participants include Jonathan Roy, Founder of UK investor Group, and owner of UK Investor Magazine, Jonathan Davis, author, columnist, investment strategist, and Editor of the Investment Trusts Handbook, and Joanne Hart, Investment Editor at Mail on Sunday.

Gallery Suite

Beaufort Society | Exploding the ESG Myths and Looking for Real Innovation in the 2020s

Graham Rowan, Chairman at Beaufort Society, demonstrates the challenges and issues with Environmental, Social and Governance (ESG), and gives examples of the growing anti-ESG sentiment. He also highlights some companies with genuine innovation that Beaufort Private Equity has invested in.

Vietnam Enterprise Investments Limited | Access to a rapidly growing economy

Charles Cade, Non-Executive Director at Vietnam Enterprise Investments Limited, makes the case for Vietnam as an investment destination, and gives an overview of the country’s stock market. He also gives advice on how to invest in Vietnam equities, and showcases Vietnam Enterprise Investments Limited as a way to gain access to this market.

Shojin | The benefits of real estate investing in 2024

Jatin Ondhia, CEO at Shojin, makes the case for investing in real estate development projects, and shows how Shojin’s co-investment model helps address the funding gap in real estate development while providing investment opportunities in the mid-market development space.

Oxford Technology Management Ltd

Lucius Cary, Founder and Managing Director at Oxford Technology Management Ltd, and Andrea Mica, Director at Oxford Technology Management Ltd, introduce Oxford Technology Management’s approach to investing in science start-ups using the SEIS and EIS schemes, and highlight several case-study investments which exemplify the company’s process and portfolio.

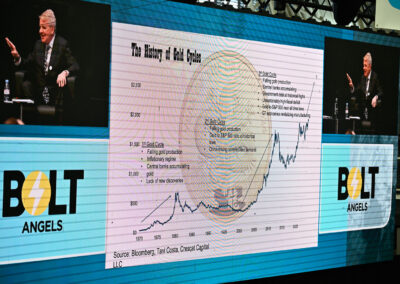

Bolt Angels | The Art and Science of Angel Investing: Seven Strategies to Outperform the Odds

Steve Bolton, Managing Partner at Bolt Angels and Lead Investor in JAAQ.ORG and Cudo Compute, shares his personal strategy for investing success, suited for both novice and experienced angel and venture investors alike. He also showcases mental health tech platform JAAQ.ORG, as well as cloud computing company Cudo Ventures, as two ventures where Bolt Angels is the lead investor.

De Pointe Research | Gold, Art and the importance of portfolio diversification in 2024

Paul Regan, Director at De Pointe Research, makes the case for alternative asset classes as a means for portfolio diversification and wealth preservation. He also shares his vision for the future of alternative investments, and illustrates how De Pointe Research supports investors in identifying and choosing these investments.

London South East | Just how undervalued is the UK Stock Market?

Led by Peter Higgins, Founder and Managing Director of Conkers3Ltd, London South East, this discussion explores the potential of the UK stock market, and identifies the stocks with the greatest investment potential once the UK has recovered from recent developments. Participants include George O’Connor, Progressive Research Technology Analyst, Stephen Yiu, Lead Manager at WS Blue Whale Growth Fund, Charlie Huggins, Head of Equities at Wealth Club, and Gervais Williams, Head of Equities at Premier Miton.

Evil Knievil | Current Times as seen by Evil Knievil (short version)

Evil Knievil (aka Simon Cawkwell) draws attention to selected investment trusts and shares, summarising their past performance and potential developments going forward.

Evil Knievil | Current Times as seen by Evil Knievil (long version)

Evil Knievil (aka Simon Cawkwell) reflects on latest developments in the capital markets, both in the UK and abroad. He also draws attention to selected investment trusts and shares, summarising their past performance and potential developments going forward.

Showcase Stage

Ananda Developments Plc | Cannabis-based medicines on the NHS

Jeremy Sturgess-Smith, Finance Director at Ananda Developments Plc, points out the potential of the global anti-inflammatory drugs market, and explains how Ananda Developments Plc addresses this opportunity through the development of NHS-approved and MHRA-licensed cannabinoid medicines.

Quebec Precious Metals Corporation | Finding gold and lithium in James Bay, Quebec

Normand Champigny, CEO at Quebec Precious Metals Corporation, updates on progress made with Quebec Precious Metals Corporation’s gold exploration efforts in the James Bay region, Quebec, Canada. Highlighting the gold flagship project, Sakami, he points out the company’s latest discovery of lithium in the region.

Kinetiko Energy | South Africa’s Transition Energy Solution

Adam Sierakowski, Executive Chairman at Kinetiko Energy, draws attention to the energy crisis in South Africa, and showcases how Kinetiko Energy helps provide an energy transition solution through a four-step approach to developing the country’s largest onshore gas field.

Pensana Plc | Pensana rare opportunity to gain direct exposure to the biggest energy transformation in history

Paul Atherley, Chairman at Pensana Plc, illustrates the growing demand for rare earths as a result of the global energy transition, and explains how Pensana Plc addresses this opportunity through the development of one of the world’s largest rare earths projects in Angola.

ASP Isotopes Inc. | Introduction to ASP Isotopes

Paul Mann, Chairman of the Board and CEO at ASP Isotopes Inc., highlights the importance of and growing demand for isotopes across many industries and defence capabilities. He also shows how ASP Isotopes plans to meet this global demand through its proprietary technology, aimed at manufacturing a range of isotopes.

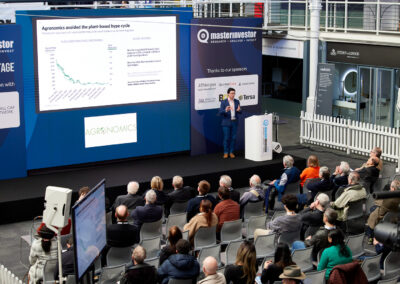

Agronomics

Anthony Chow, Co-founder of Agronomics, reflects on some of the headwinds of the plant-based alternatives sector over the past years, while stressing a more positive outlook for the cellular agriculture industry. He also showcases several companies that form part of the Agronomics portfolio.

Dart Mining NL

James Chirnside, Managing Director and Chairman at Dart Mining NL, gives an overview of Dart Mining’s exploration footprint and project pipeline, and updates on progress made as well as scheduled works for 2024 for some of the company’s exploration projects in Eastern Australia.

Symvan Capital | Venture Capital Investing – Creating Alpha For Private Client Portfolios

Kealan Doyle, CEO at Symvan Capital, makes the case for early stage technology investing, and outlines the pros and cons of investing in both EIS and VCT. Explaining the importance of fees when selecting an EIS manager, he introduces Symvan Capital’s own fee model.

Bradda Head Lithium | Advancing lithium exploration in the USA battery supply chain

Ian Stalker, Executive Chairman at Bradda Head Lithium, makes the case for the USA as an investment destination, and outlines Bradda Head Lithium’s aim to become a supplier of lithium to the American battery market. He also showcases the company’s lithium projects across the United States, and gives an overview of progress made to date as well as scheduled works.

Juvenescence

David Gill, CFO at Juvenescence, outlines the challenges of an ageing population while highlighting the opportunities arising from those challenges. He also shows how Juvenescence seeks to monetize those opportunities through investing into healthspan and longevity, with a particular focus on drugs with a near-term potential to treat age-related diseases.

SEED Innovations Limited | Unlocking Investment Potential: SEED Innovations Limited

Ed McDermott, CEO at SEED Innovations Limited, introduces SEED Innovations Limited’s approach to investing into disruptive companies across biotech, life sciences, medical cannabis, and wellness. He also provides a detailed portfolio breakdown, and delves into some of the companies that the fund is invested in.

Testimonials

Sponsors

SUBSCRIBE

FOLLOW US