MASTER INVESTOR SHOW 2025

The UK's largest event for private investors

Business Design Centre, London, 29 March 2025

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

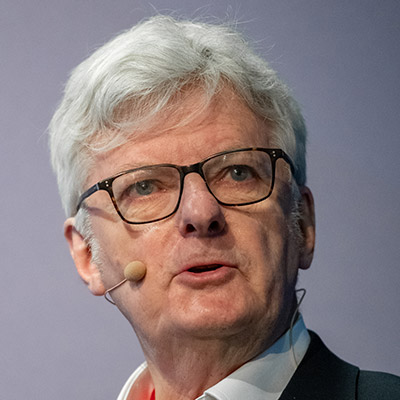

Jonathan Maxwell

CEO, Sustainable Development Capital LLP

Jonathan is founder and CEO of SDCL. He has 25 years’ experience in international finance, infrastructure and private equity and has overall responsibility for SDCL’s investment activities. He is chair of the Investment Committee for SDCL Energy Efficiency Income Trust plc (SEEIT). Since establishing SDCL in London in 2007, the group now operates across the UK, Europe, North America and Asia and has launched energy efficiency project investment funds in the UK, Ireland, Singapore and New York. He has advised and invested on behalf of a number of national governments as well as a wide range of institutional investors. Since 2012, SDCL has launched a number of innovative investment vehicles including the London Stock Exchange listed SEEIT. Prior to establishing SDCL, Jonathan was at HSBC Infrastructure and managed the IPO of the HSBC Infrastructure Company, the first Main Market, London Stock Exchange listed infrastructure fund, which now has an enterprise value of over £3 billion. Jonathan recently published his first book, The Edge: How competition for resources is pushing the world, and its climate, to the brink – and what we can do about it. Jonathan has a degree in Modern History from Oxford University.

Company profile: SDCL Energy Efficiency Income Trust plc (SEEIT)

SEEIT is a constituent of the FTSE 250 index and holds the London Stock Exchange’s Green Economy Mark. It was the first UK listed company of its kind to invest exclusively in the energy efficiency sector. Its projects are primarily located in North America, the UK and Europe and include, inter alia, a portfolio of cogeneration assets in Spain, a portfolio of commercial and industrial solar and storage projects in the United States, a regulated gas distribution network in Sweden and a district energy system providing essential and efficient utility services on one of the largest business parks in the United States.

The Company aims to deliver shareholders value through its investment in a diversified portfolio of energy efficiency projects which are driven by the opportunity to deliver lower cost, cleaner and more reliable energy solutions to end users of energy.

The Company is targeting an attractive total return for shareholders of 7-8 per cent. per annum (net of fees and expenses and by reference to the initial issue price of £1.00 per Ordinary Share), with a stable dividend income, capital preservation and the opportunity for capital growth. The Company is targeting a dividend of 6.24p per share in respect of the financial year to 31 March 2024.

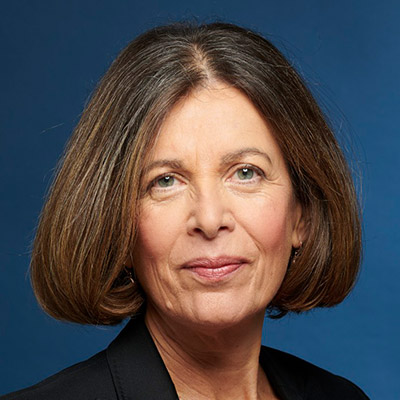

Charles Cade

Vietnam Enterprise Investments Limited

James Carthew

QuotedData

James Chirnside

Dart Mining NL

Jonathan Davis

Author, columnist, investment strategist; Editor Investment Trusts Handbook

Wilfred Frost

Host speaker

Peter Hamid

NextEnergy Capital

Joanne Hart

Mail on Sunday

Peter Hewitt

Columbia Threadneedle Investments, Global Managed Portfolio Trust

Victor Hill

Master Investor

Sarah Lowther

Master Investor

Edward Marten

QuotedData

Jim Mellon

.

Gaurav Narain

India Capital Growth

Paul Niven

Columbia Threadneedle, F&C Investment Trust

Minesh Shah

TRIG

Mark Watson-Mitchell

Master Investor

Richard Wolanski

Kinetiko Energy

Stephen Yiu

WS Blue Whale Growth Fund

abrdn

Speaker tbc

Agronomics

Speaker tbc

Ananda Developments Plc

Speaker tbc

Aurora Investment Trust

Speaker tbc

Baillie Gifford

Speaker tbc

Barton Gold

Speaker tbc

Calibre Mining

Speaker tbc

CBOE

Speaker tbc

Invesco

Speaker tbc

J.P. Morgan Asset Management

Speaker tbc

JPMorgan Global Growth & Income plc

Speaker tbc

Oakley Capital

Speaker tbc

Polar Capital

Speaker tbc

Quebec Precious Metals Corporation

Speaker tbc

The Mercantile Investment Trust plc

Speaker tbc

Get your ticket

Don't miss out on the UK's largest event for private investors - secure your ticket today.